Nvidia: World’s Top Company Driven by AI and Crypto

4 min read

Buzzy News

Nvidia has reached the pinnacle of being the world’s most valuable company following a surge in its share price to an all-time high on Tuesday. The stock closed at nearly $136, a 3.5% increase, elevating Nvidia above Microsoft in market value, a milestone it previously surpassed Apple earlier this month.

Nvidia’s success is largely attributed to its production of computer chips essential for artificial intelligence (AI) software, a sector experiencing substantial growth in demand. Additionally, the cryptocurrency boom over the last decade has significantly boosted Nvidia’s sales. Nvidia produces high-performance GPUs that are widely used by crypto miners to process transactions and generate new coins. The heightened demand for these GPUs during various cryptocurrency surges has substantially contributed to Nvidia’s revenue. For example, during the cryptocurrency bull markets, the demand for Nvidia’s GPUs surged, driving up prices and sales volumes. Nvidia’s market valuation has skyrocketed from approximately $14 billion in 2014 to $3.34 trillion (£2.63 trillion) in 2024, reflecting a more than 200-fold increase over the past decade.

With the latest stock rally, Nvidia’s market valuation has soared to $3.34 trillion (£2.63 trillion), marking a near doubling of its stock price since the start of the year. Remarkably, the stock was valued at less than 1% of its current price just eight years ago.

The fierce competition among AI developers, including major tech companies like Microsoft, Alphabet (Google’s parent company), Meta, and Apple, has further benefited Nvidia. Every major tech corporation is integrating AI into its devices and services, and the hardware required for these AI capabilities is predominantly provided by Nvidia. Microsoft uses Nvidia’s GPUs in its Azure cloud computing platform to offer AI and machine learning services. Alphabet employs Nvidia’s technology to power its AI-driven services like Google Assistant and Google Photos. Also read our article on Microsoft vs Apple, here. Meta leverages Nvidia’s GPUs for its AI research and virtual reality initiatives. Even Apple, which designs its own chips, relies on Nvidia for certain high-performance tasks in its AI and machine learning applications. This extensive integration of AI across the tech industry has reinforced Nvidia’s dominant position in the AI chip market, bolstering investor confidence in its future value appreciation. Nvidia’s financial performance has consistently exceeded analysts’ expectations in recent years.

One of the pivotal factors driving Nvidia’s ascent is its innovative technology and strategic foresight in the AI sector. The company’s GPUs (graphics processing units) are not only central to gaming but have become indispensable in AI research and applications. Nvidia’s CUDA platform, which allows developers to harness the power of its GPUs for parallel processing, has been a game-changer, making the company’s products a cornerstone in the AI industry.

Nvidia’s strategic partnerships and acquisitions have also played a crucial role in its growth. The company’s acquisition of Mellanox Technologies in 2020 expanded its data center capabilities, a move that has paid dividends as demand for data center solutions has skyrocketed. Furthermore, Nvidia’s collaboration with leading cloud service providers has cemented its position as a key player in the AI infrastructure landscape.

Nvidia recently unveiled its next-generation GPU architecture, codenamed Blackwell, which promises to be a significant leap forward in AI computing. Blackwell GPUs are designed to offer unprecedented performance, efficiency, and scalability, making them ideal for the most demanding AI and machine learning workloads. This new hardware is expected to drive further growth for Nvidia as industries increasingly adopt AI technologies. Looking ahead, industry insiders speculate that Nvidia may launch GPUs specifically tailored for emerging AI applications, such as autonomous driving and edge computing. These advancements are likely to play a crucial role in sustaining Nvidia’s stock price growth in the near future.

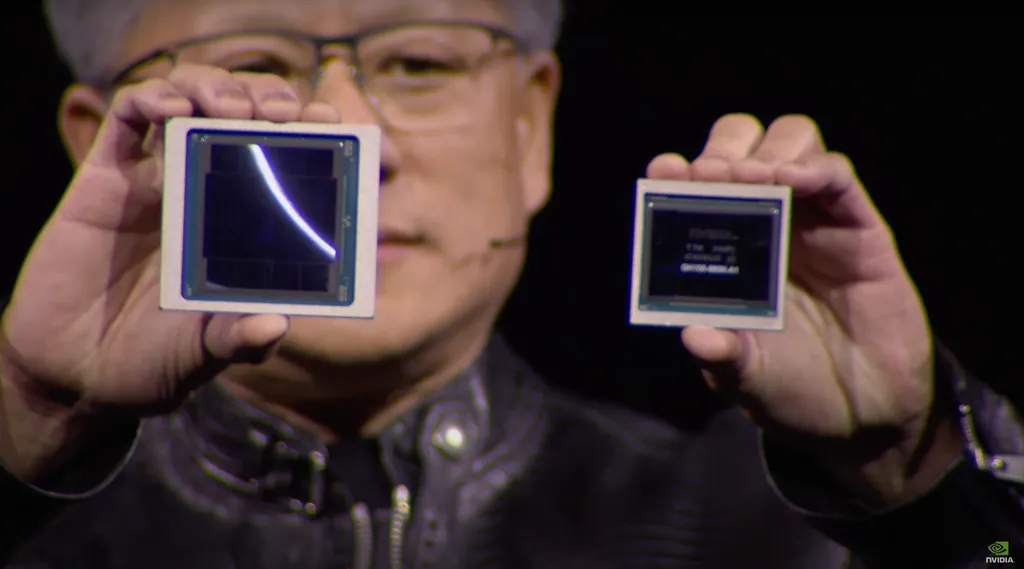

Jensen Huang, Nvidia’s co-founder and CEO, has been instrumental in transforming the company into a trillion-dollar giant. Under his visionary leadership, Nvidia has consistently pushed the boundaries of innovation, from pioneering GPU technology to leading the AI revolution. Huang’s strategic decisions and ability to foresee industry trends have not only kept Nvidia at the forefront of technological advancements but have also garnered immense investor trust and confidence.

Overall, Nvidia’s remarkable ascent underscores the critical role of AI technology in shaping the future of the tech industry, with the company at the forefront of this transformative trend. As Nvidia continues to innovate and expand its market presence, it remains a focal point for investors and tech enthusiasts alike, symbolizing the profound impact of AI on modern technology. With ongoing advancements and strategic leadership, Nvidia is well-positioned to maintain its upward trajectory and continue influencing the tech landscape.